Certent Disclosure Management (CDM)

Reduce Disclosure Risk for Regulatory, External, and Internal Reports

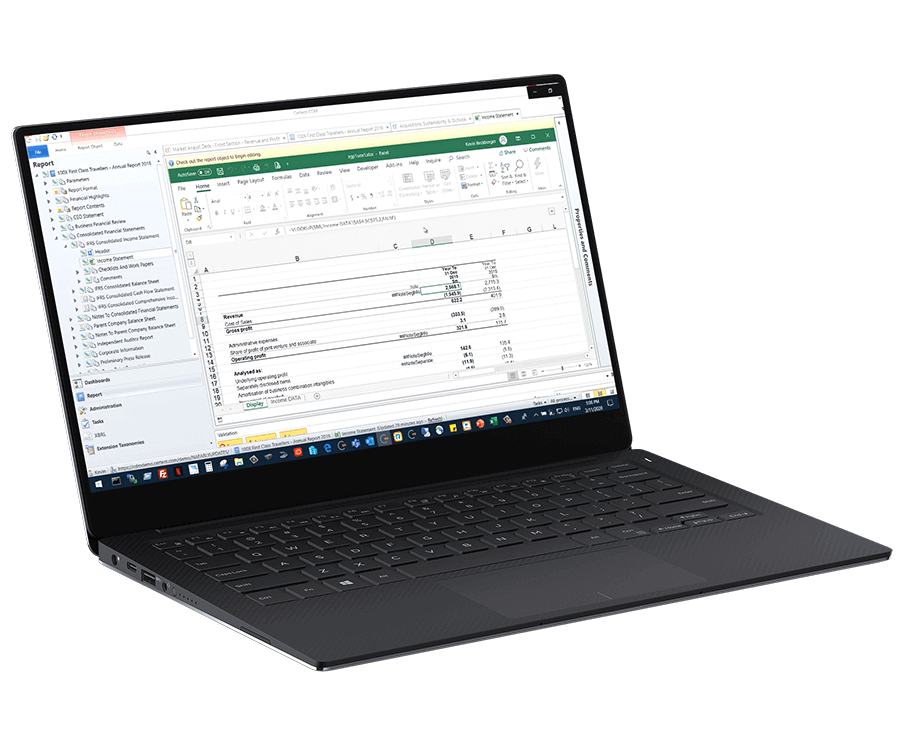

The Only All-in-One Disclosure Management System, Built on Microsoft Office, for External and Internal Report Creation

"*" indicates required fields

Do Your High Frequency, Recurring, Multi-Author Reports

Suffer These Production Challenges?

Too Much Time Spent on Low-Value Activities, Including Constant Editing and Checking

Hours are spent manually copying and pasting data from source systems or disparate spreadsheets and passing files back and forth over poorly controlled channels, such as email, which puts the integrity of your process at risk.

Every Reporting Period You Have to Reinvent the Wheel, Updating Your Narrative Manually

Gathering text, narrative, and analysis from multiple systems for annual reports, investor press releases, results presentations, board packs, etc., is a time-consuming, manual process. With no automation to enable you to roll forward these narratives to the next period, you find yourself reinventing the wheel period after period.

Numbers or Facts within Final Reports can be Out of Date Before the Report is Even Published

If you don’t have a direct link from the numbers and comparatives in your commentary to your source data, then every time your source system changes you need to manually update and recheck every piece of narrative across every document. This is tedious and risks introducing errors and inconsistencies, particularly with last-minute changes.

Trusted By

Reduce Risk with the Only All-in-One, Microsoft Office-Based Disclosure Management Solution

Halve the Time Spent Creating Internal and External Narrative Reports

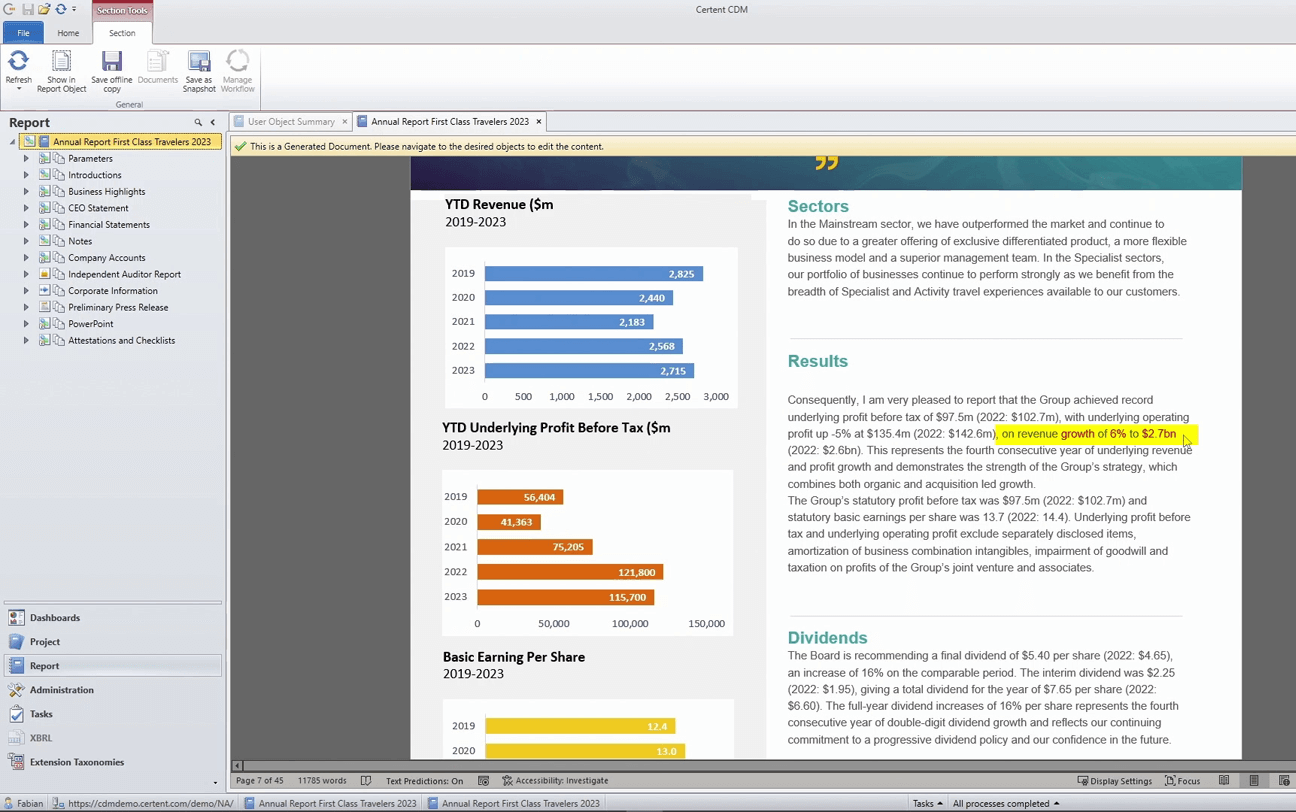

Produce and format regulatory, internal, and external reports with ease by working within the Office products you already know how to use. Automatically roll forward documents to the next period to compress production cycles. Drive economies of scale by sharing content across multiple reports and distributing in multiple output formats: Word, PDF, PowerPoint, Adobe InDesign, XBRL/iXBRL, etc. Save time and money by reducing proofing cycles with external printers and eliminating the 24-hour plus pencil-down period.

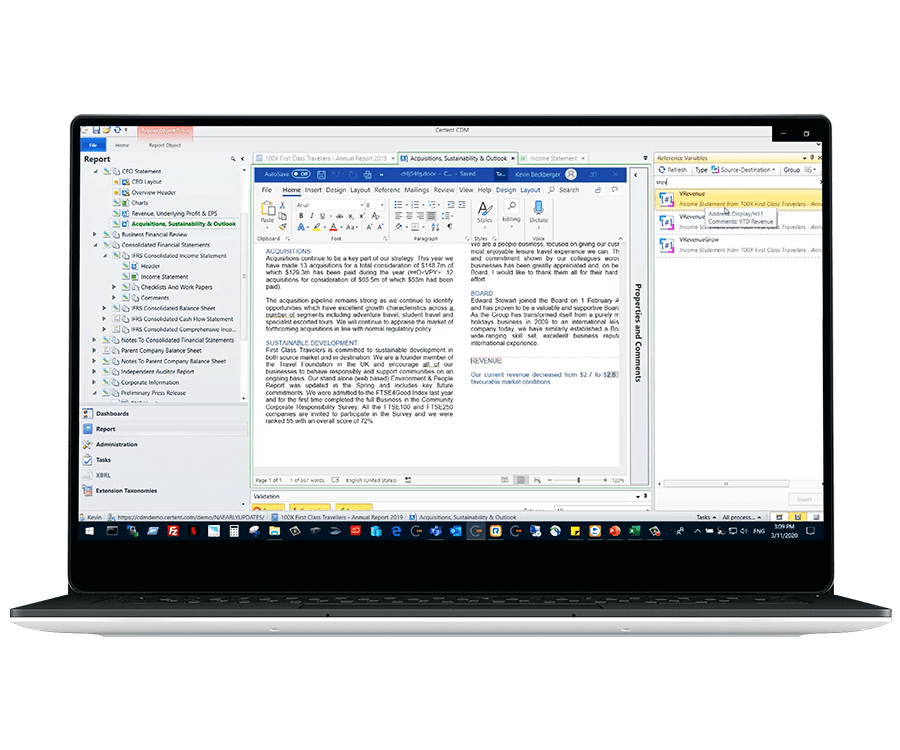

Increase Confidence with Bulletproof Accuracy, Even with Late Changes

Always tell the most accurate story around your company results, with confidence. Strong access controls and single sign-on ensure only authorized users can change and approve narrative. Workflow controls streamline and expedite the production cycle. Process task and check lists provide simple guidance to keep everything on track. An audit trail lets you see who did what and when, while validation rules tie out one part of the document to another part, or to a different document, to accelerate the review cycle.

Ensure Every Report is Always in Perfect Alignment

Direct connectivity to your source data and the ability to add links to data items into your narrative that are shared within and across documents ensure that you have a single version of the truth for consistent reporting. Refresh your data at any time to automatically update your report narrative as your numbers fluctuate to reduce the risk of manual errors.

BEST-IN-CLASS FEATURES

Familiar Microsoft Office Integration

For Ease of Adoption

- Use existing skills to create composite documents containing numbers, charts, and text

- Collaborate using standard Microsoft Office comments

- Extend Microsoft Office functionality with added security, audit trail, and automated data integration

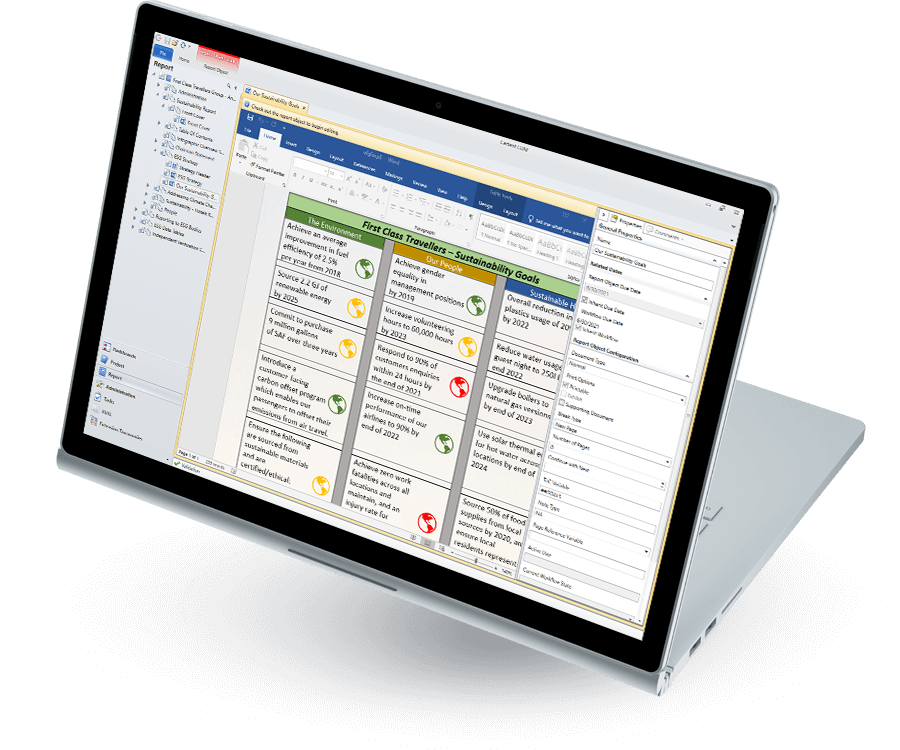

Automated Narrative Reporting

For Consistency Across Internal and External Reporting

- Automatically roll over reports to the next period, with the latest data, to jump start the report creation process

- Build documents from pre-existing sections, allowing experts to focus on their individual components

- Use dynamic text based on variables you define to ensure all reports always reference the correct narrative or single data point

- Choose multiple output options including Word, PowerPoint, PDF, Adobe InDesign, and High Definition HTML, iXBRL, XHTML

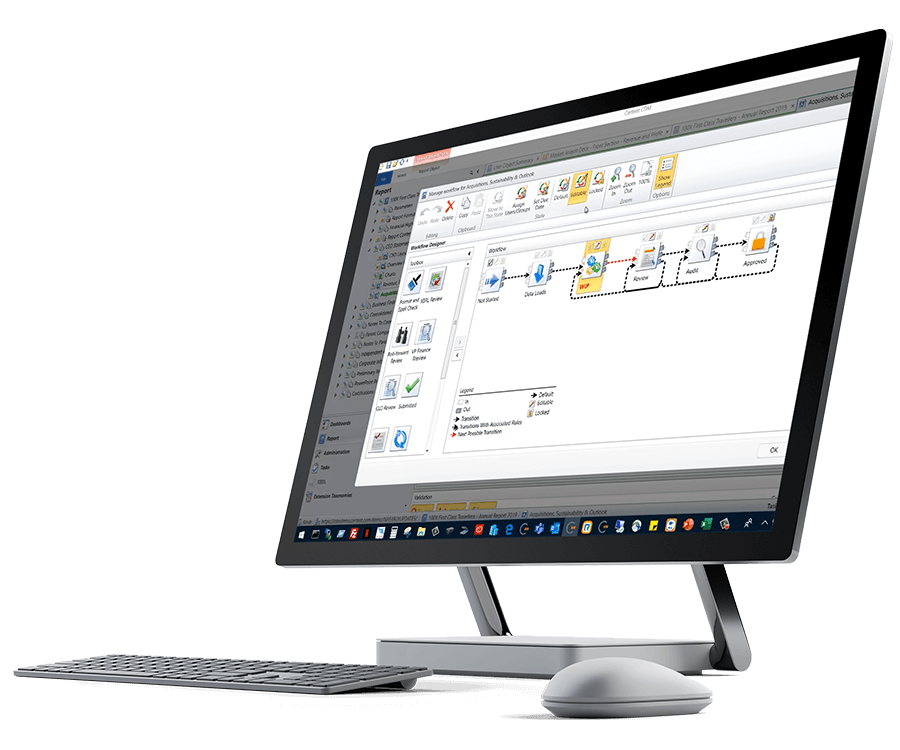

Version Control, Workflow, and Audit Trail

To Reduce Risk and Ensure Security

- Track the status of each document section, with due dates, responsibility assignments, and automated notifications to keep everything on track

- Ensure employees only see the information they’re authorized to access, and only when they need it.

- Use standard Word blackline functionality to compare versions and see who changed what and when

- Use configurable business rules to identify potential issues within and across documents, during the review cycle

Direct Multi-Data Source Connection

Refresh at Any Time to Have the Latest Data in Hand

- Link narrative and data in reports directly back to source data to ensure there are no conflicting numbers or narrative anywhere in a report

- Automatically cascade changes to source numbers through all reports to ensure a single version of the truth and eliminate human error

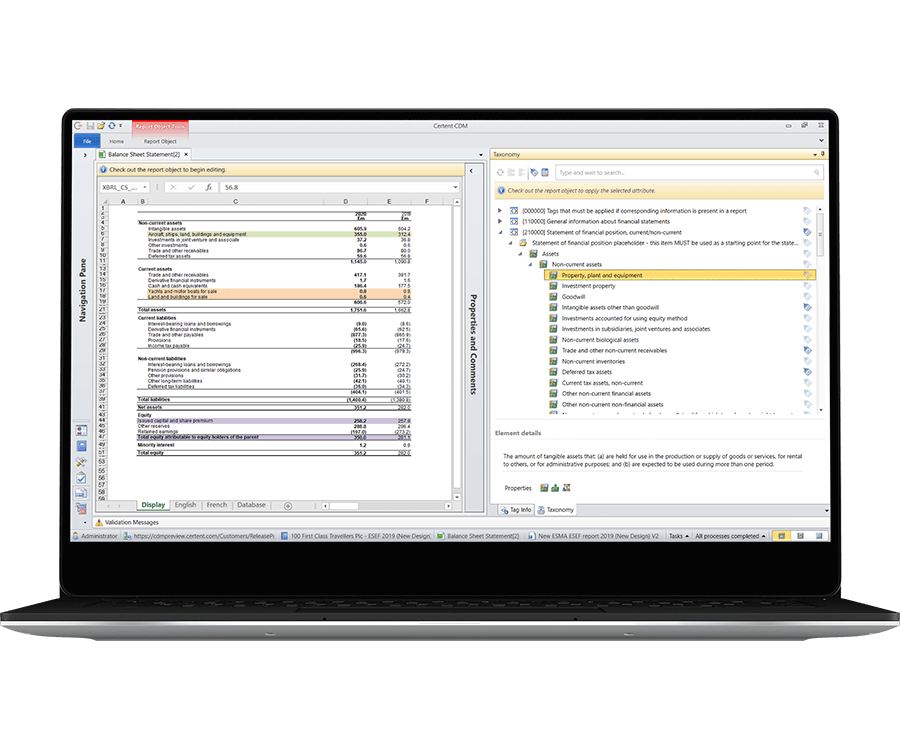

XBRL Tagging Done Right

Enable multi-national organizations to use a single reporting/tagging solution

- Real-time validation on XBRL documents to instantly flag any errors to improve overall quality in first and subsequent filings.

- Support for global XHTML mandates including compliance with ESMA/ESEF

- Tag data once and roll the report forward using the same tags with updated values to reduce risk and eliminate redundancy.

- Web-based reviewer enables users and management to review and approve iXBRL documents for accuracy and data quality before filing

- File even complex, multi-document iXBRL filings directly with SEC Filing Wizard to save time and cost

- Taxonomy management ensures hassle-free ongoing compliance

- Real-time tagging grid shows a dynamic preview of your document as you tag the data, allowing you to see a side-by-side comparison of your initial document and your XBRL tags

Ready to go beyond Disclosure Management?

Certent Disclosure Management is one of insightsoftware's unified, modular applications. Select the capabilities you need across budgeting & planning, controllership, and reporting to get more done with less risk by bringing all your insightsoftware applications together in one place.

How to Choose a Disclosure Management Software Solution

Financial professionals know the quarterly drill of yet another period close all too well. That’s when the disclosure process — that time-consuming, manual, error-prone proposition — takes center stage.

Work with the Industry’s Only All-in-One Disclosure Management Solution Based on Microsoft Office

The cloud option means that we don’t have the risk and maintenance costs of having physical hardware on-premise.

Speak to an Expert