With Cap Table Management Software You Can Reach New Levels of Insight and Analysis

Enjoy More Organized Data, Easier Decision Making, and Enhanced Communications with a Cap Table Management Solution That Supports Your Needs

Do Your Cap Table Processes Suffer

from These Challenges?

Struggle to Quickly Access Your Data

You need reliable and accurate data to hold up your end of shareholder and employee communication needs. But how quickly and easily can you create and update accurate ledger-based cap tables?

Manually Modeling Every Funding Scenario?

As your company grows and prepares for the next round of funding, do you struggle to easily model and compare pre/post-round-of-funding scenarios?

Spreadsheets Can’t Scale and are Error Prone

As the number of plan participants increases, do you find it harder to keep track of employee awards and equity grants while ensuring that shareholders can easily access essential information?

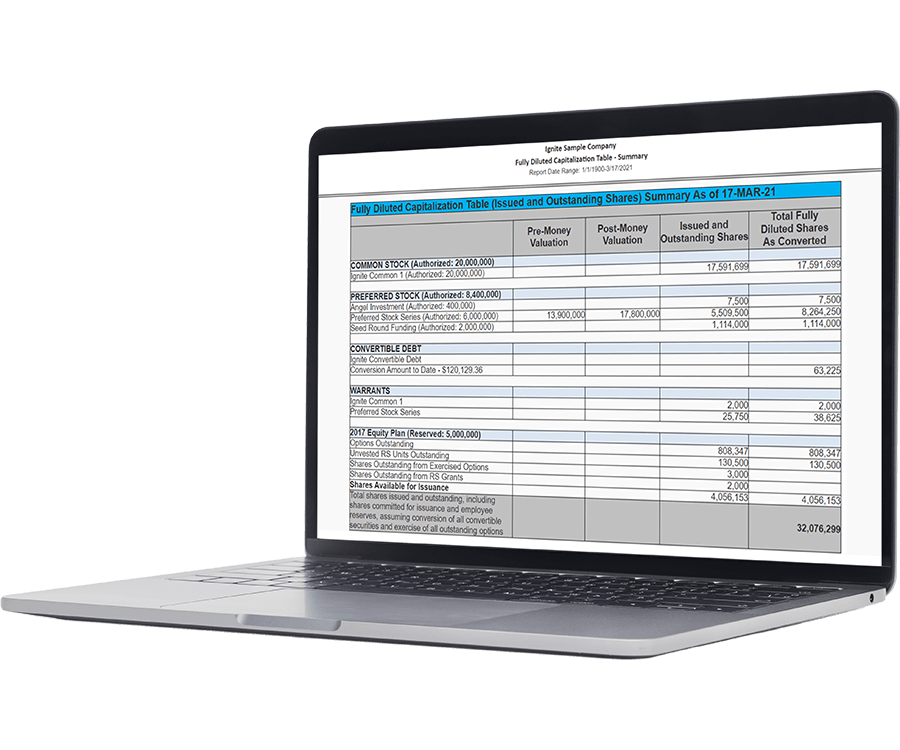

Generate Accurate Ledger-Based Cap Tables

Deliver a new level of insight and analysis that grows with your business, underpinned by more organized data for better decisions, and enhanced communications. Generate cap tables by date, ensuring that you have a comprehensive view of stakeholder holding from a trusted single source of truth.

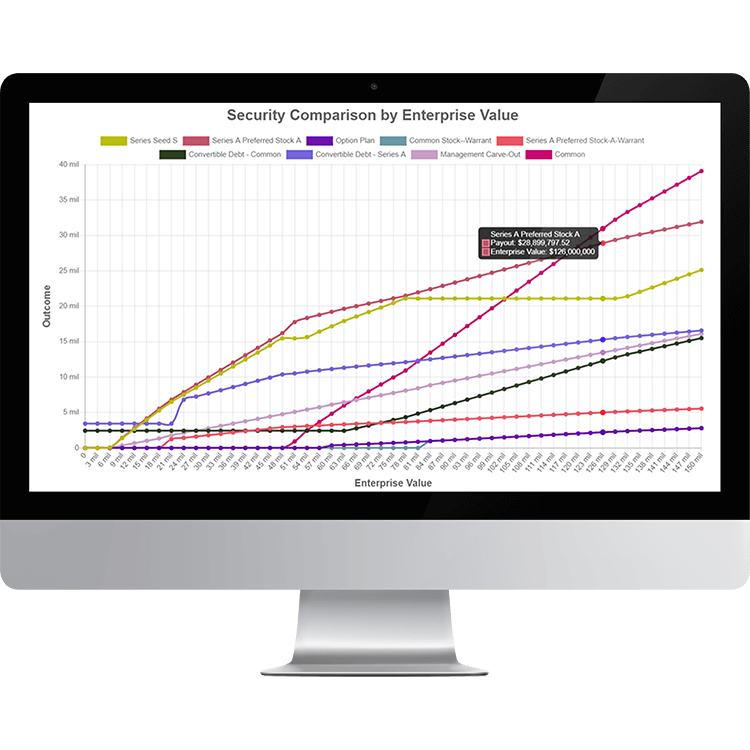

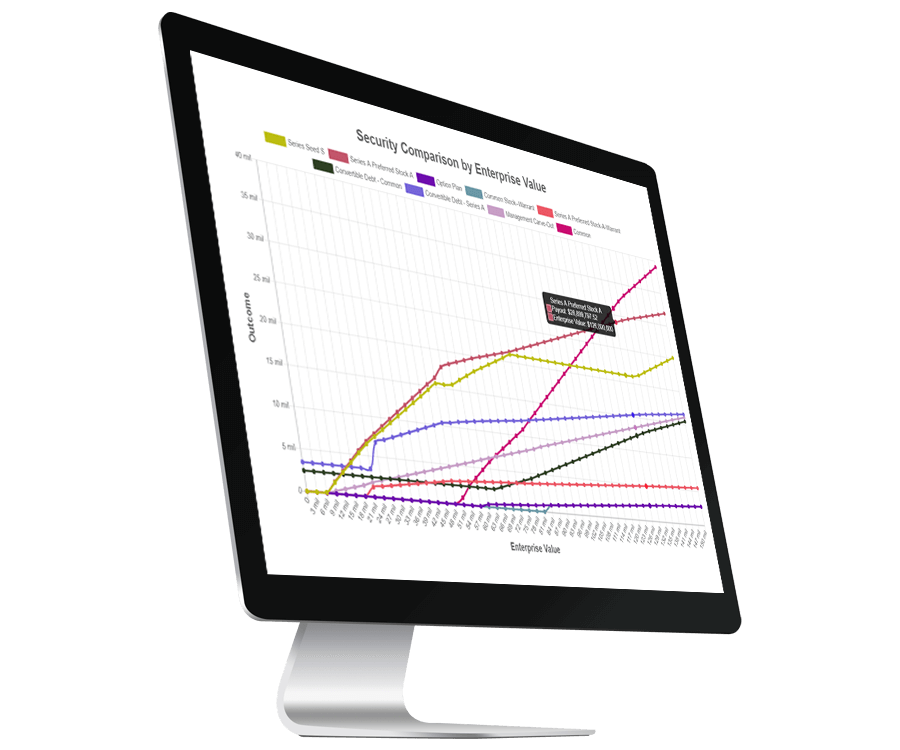

Waterfall Analysis

Create high-impact distribution waterfalls to identify the pay-out for each class of security at any exit amount, so you can model and compare various term sheets and analyze the capitalization outcomes.

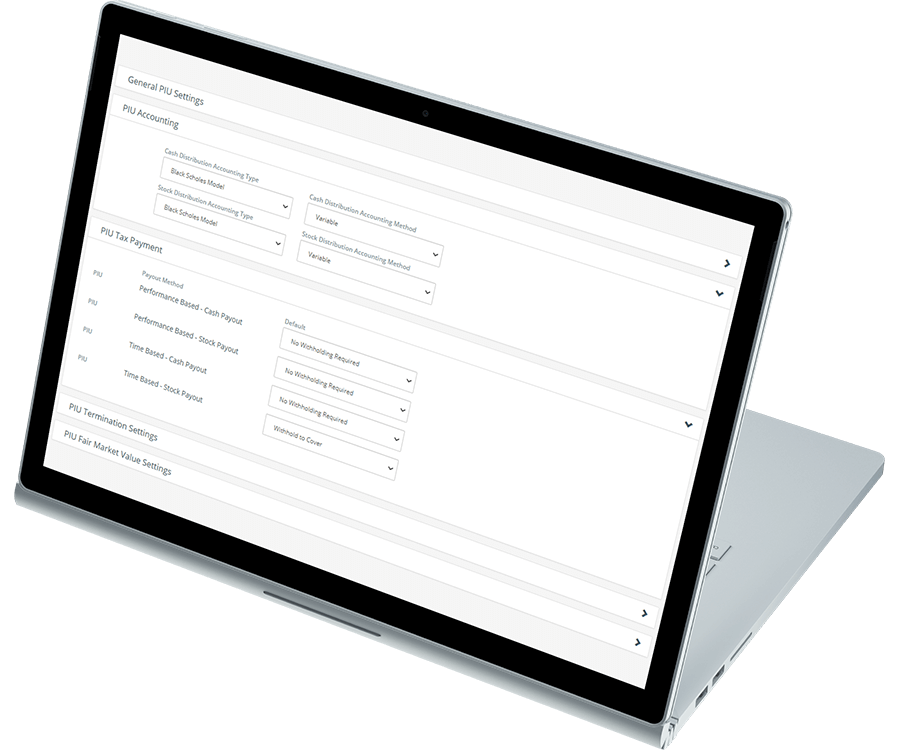

LLC Support

Enjoy extensive support and rich capabilities for LLCs and complex capital structures, robust Profit Interest Units (PIUs), and Management Incentive Units (MIUs) awards.

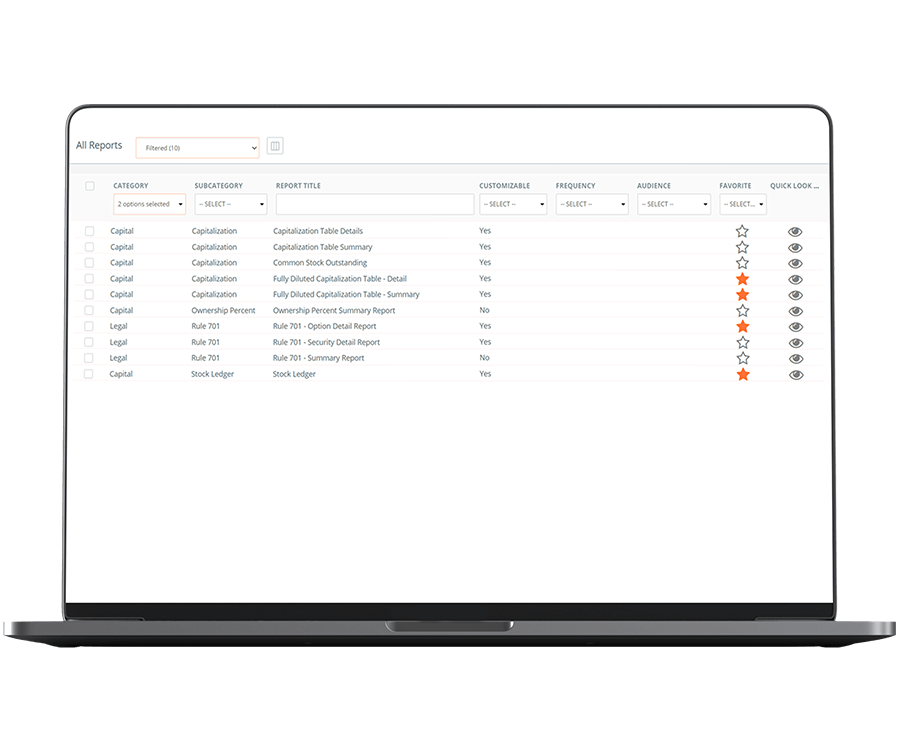

Comprehensive Reporting

Manage your funding rounds including convertible debt and SAFE agreements. Detailed reporting and administrative capabilities ensure you have all the data you need to make decisions and communicate quickly.

Integrates with:

- Oracle E-Business Suite (EBS)

- Oracle EPM Cloud

- Oracle ERP Cloud

- Oracle Essbase

- Oracle Financial Consolidation and Close (FCCS)

- Oracle Fusion

- Oracle Hyperion Enterprise

- Oracle Hyperion Financial Management (HFM)

- Oracle Hyperion Planning

- Oracle PeopleSoft

- Oracle Planning and Budgeting Cloud Service (PBCS)

- Oracle Tax Reporting

- Dynamics 365 Business Central

- Dynamics 365 Finance and Supply Chain Management

- Dynamics AX

- Dynamics CRM

- Dynamics GP

- Dynamics NAV

- Dynamics NAV C5

- Dynamics SL

- SQL Server Analysis Services (SSAS)

- Deltek Ajera

- Deltek Maconomy

- Deltek VantagePoint

- Deltek Vision

- Deltek Vision Cloud

- Viewpoint Spectrum

- Viewpoint Vista

- MRI Commercial Management

- MRI Financials

- MRI Horizon

- MRI Horizon CRE

- MRI Qube Horizon

- MRI Residential Management

- Epicor Avante

- Epicor BisTrack

- Epicor CMS

- Epicor Enterprise

- Epicor Epicor SLS

- Epicor iScala

- Epicor Kinetic

- Epicor LumberTrack

- Epicor Manage 2000

- Epicor Prophet 21

- Epicor Tropos

- Infor CloudSuite Financials

- Infor Distribution SX.e

- Infor Financials & Supply Management

- Infor Lawson

- Infor M3

- Infor System21

- Infor SyteLine

- Sage 100

- Sage 100 Contractor

- Sage 200

- Sage 300

- Sage 300 CRE (Timberline)

- Sage 500

- Sage 50cloud Accounting

- Sage AccPac

- Sage Adonix Tolas

- Sage Estimating

- Sage Intacct

- Sage MAS

- Sage X3

- 24SevenOffice

- A+

- AARO

- AccountEdge

- Accounting CS

- Accountmate

- Acumatica

- Alere

- Anaplan

- Aptean

- Assist

- ASW

- Aurora (Sys21)

- Axion

- Axis

- BAAN

- Banner

- Blackbaud

- BlueLink

- Book Works

- BPCS

- Cayenta

- CCH

- CDK Global

- CedAr e-financials

- CGI Advantage

- Clarus

- CMiC

- CMS (Solarsoft)

- Coda

- Coins

- Colleague

- CPSI

- CSC CorpTax

- Custom

- CYMA

- DAC

- Data Warehouse

- Datatel

- DATEV

- Davisware Global Edge

- Davisware S2K

- Deacom

- DPN

- e5

- eCMS

- Eden (Tyler Tech)

- Emphasys

- Entrata

- Etail

- Expandable

- FAMIS

- Famous Software

- Fern

- FinancialForce

- FireStream

- FIS

- FiServ

- Flexi

- Fortnox

- Foundation

- Fourth Shift

- Friedman

- Full Circle

- GEMS

- Harris Data (AS/400)

- HCS

- HMS

- IBM Cognos TM1

- IBS

- IBS-DW

- In-House Developed

- Incode

- INFINIUM

- IQMS

- iSuite

- Jack Henry

- Jenzabar

- JobBOSS

- Jonas Construction

- M1

- Macola

- MACPAC

- Made2Manage

- MAM

- MAM Autopart

- Manman

- Mapics

- McLeod

- MEDITECH

- MFG Pro

- MicrosOpera

- MIP

- Mitchell Humphrey

- Movex

- MRI

- MSGovern

- Munis (Tyler Tech)

- New World Systems

- Onesite

- Onestream XF

- Open Systems

- PDI

- Penta

- Plexxis

- PowerOffice

- PRMS

- Pro Contractor

- ProLaw

- Q360

- QAD

- Quantum

- Qube Horizon

- QuickBooks Desktop Premier

- QuickBooks Desktop Pro

- Quickbooks Enterprise

- QuickBooks Online

- Quorum

- RealPage

- REST API

- Retalix

- Ross

- SmartStream

- Spokane

- Springbrook

- Standalone DB with ODBC/DSN connection

- Standalone IBM DB

- Standalone Oracle DB

- Standalone SQL DB

- SUN

- Sunguard

- SunSystems

- Sys21

- SyteLine

- TAM (Applied Systems)

- Thomson Reuters Tax

- Timberline

- TIMELINE

- Traverse

- TripleTex

- Unit4

- Unit4 Agresso

- Unit4 Business World

- Unit4 Coda

- USL Financials

- Vadim

- VAI-System 2000

- Vantage

- Vertex

- Visma

- Winshuttle

- Wolters Kluwer CCH Tagetik

- WorkDay

- Xero

- xLedger

- Xperia

- Yardi

- Yardi-SaaS

3 Ways To Up Your Financial Reporting Game

As a finance professional, you have a talent for turning numbers into information and guiding the business to make important decisions with confidence. But a problem arises when we assume that the rest of the business feels the same way about data and has the skills look at a spreadsheet or financial report and understand it the same way finance does.

Discover:

- How humans process information and how we can use this to present data in a way that is easier to consume

- Why data is only one-third of the information equation, and how leveraging context can help

- The way collaboration can be integrated into the financial reporting process

- The true importance of real-time and how it can no longer be a “nice-to-have”

The Equity Management Solution Rated #1

for Customer Satisfaction

"Certent Equity Management is easy to use, it is easy to administer data, and the support team is very courteous and responsive. The help section is really helpful."

Speak to an Expert