Certent Equity Management Software

Streamline Administration, Tighten Compliance, and Minimize Risk of Managing Equity Compensation Plans with Certent Equity Management Software

Equity Management Software and Administration Services for Public and Private Companies

"*" indicates required fields

Do Your Equity Administration and Reporting Processes Suffer from These Challenges?

You Spend Too Much Time on Low-Value, Manual Processes

Equity administration is often punctuated by periods of high-volume activity, making it especially difficult to manage alongside your other day-to-day responsibilities. Whether you’re facing stock grant refreshes, or experiencing a period of rapid growth, filings, and manual processes such as financial reporting for ASC 718 can become overwhelming.

You Face Increased Pressure to Meet Financial Compliance Requirements

There’s little confidence to be found in relying on manual processes for your equity plan administration. Manually administering equity plans, cap tables, and financial disclosures is time consuming and error prone. From lack of integration across systems to the lack of audit trails and security constraints for your manual Excel-based reporting, you know you’re putting your organization’s regulatory compliance at risk.

Your Existing Platform Can’t Scale to Support Your Growing Business

As your company has grown, you’ve found that tracking and managing equity plans is becoming exponentially more difficult. Managing your equity plan on spreadsheets worked well enough in the beginning, but as you go through more funding rounds or maybe an IPO, your disclosure and compliance requirements will become much more complex, and the penalties for getting it wrong infinitely more serious.

Trusted By

Enjoy extensive support and rich capabilities for LLCs and complex capital structures.

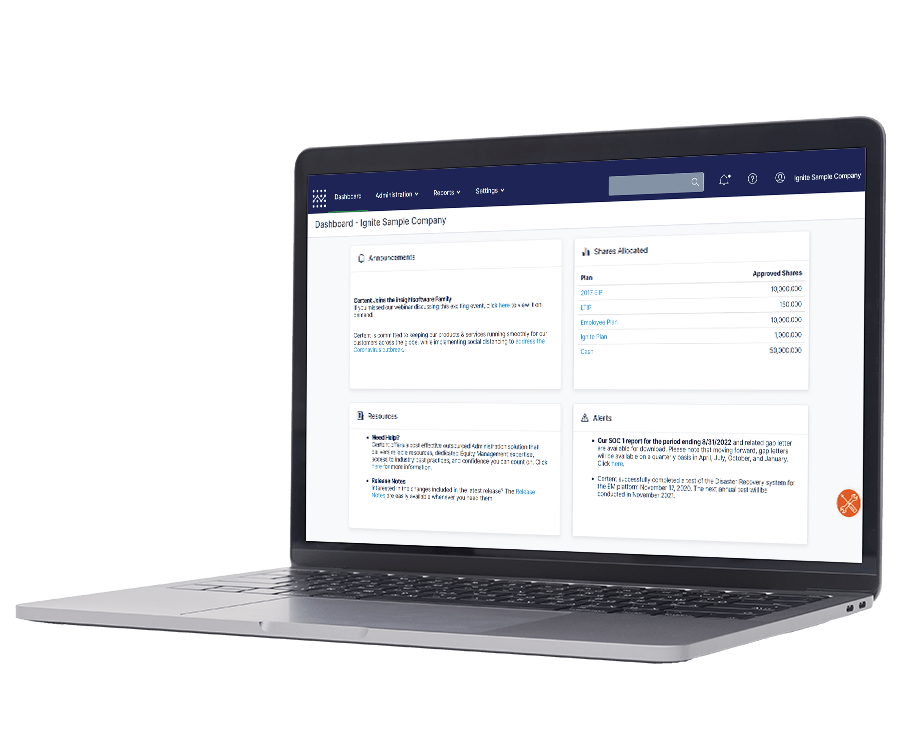

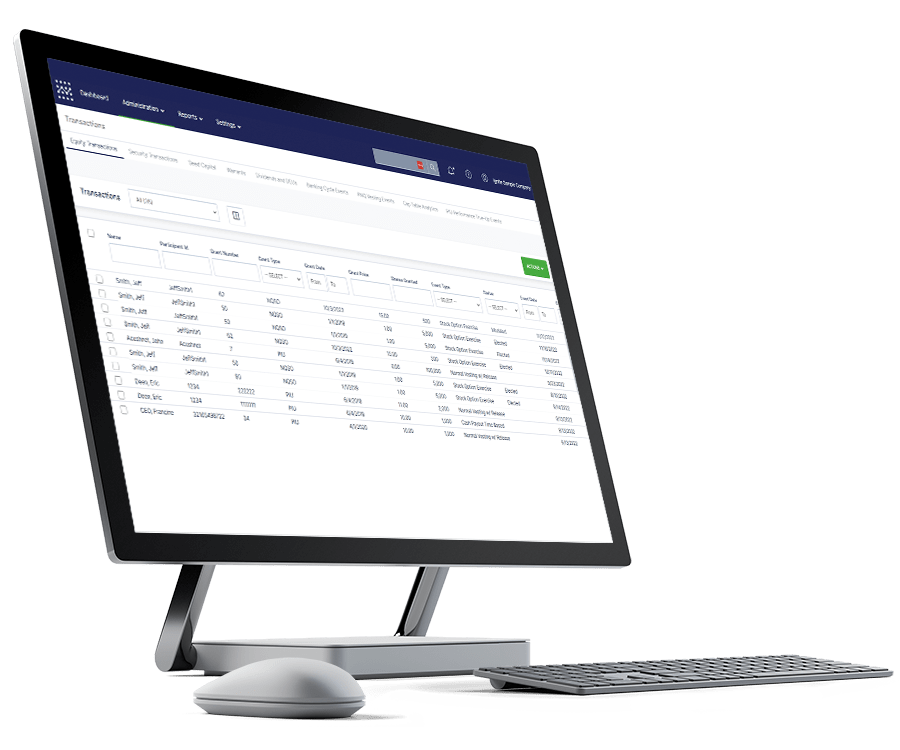

Automate and Streamline the Administration of Stock Options and Grants

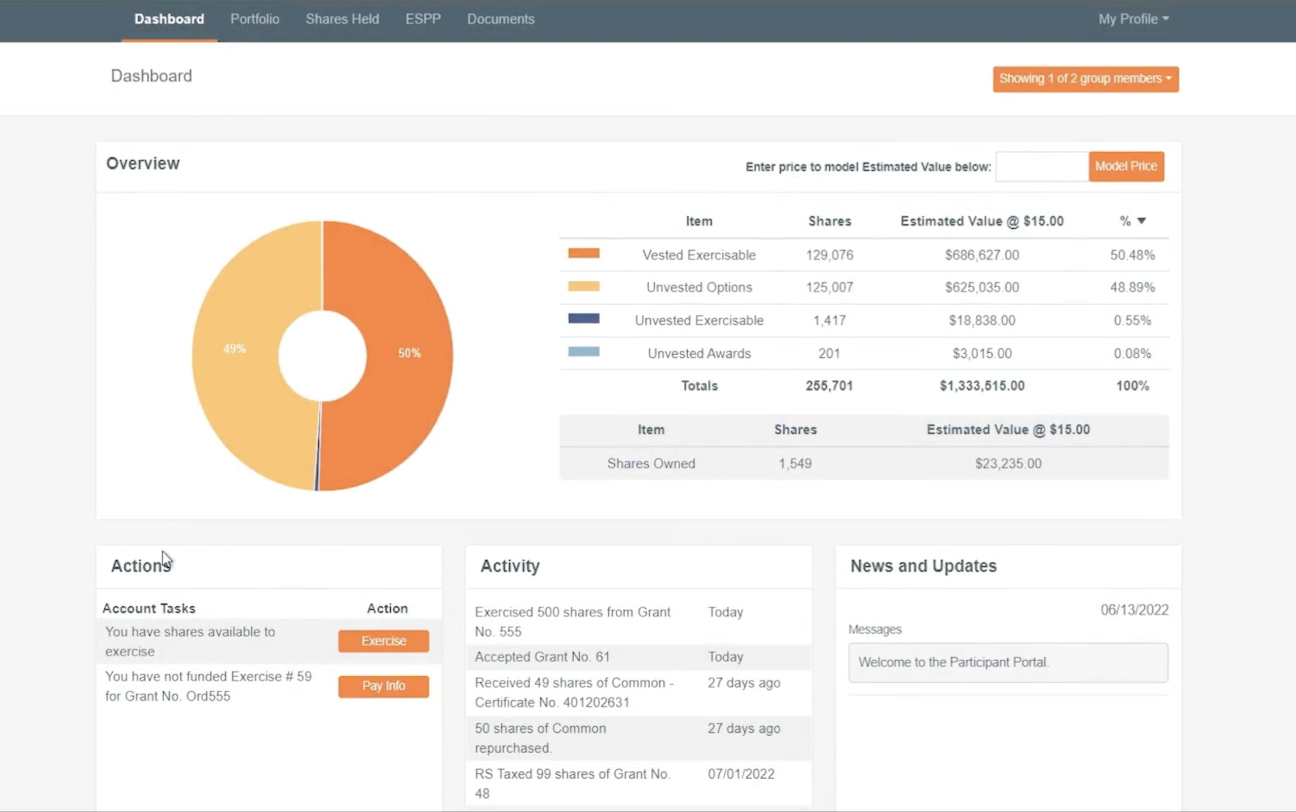

With a participant/shareholder portal, administrative role, and console, plus over 400 pre-built reports, you can streamline equity compensation processes, improve productivity, and tighten compliance across the entire organization. Automate manual processes and eliminate spreadsheets with a simplified web-based platform for complete SEC, FASB, and IFRS calculations and support for over 15 award types.

Tighten Compliance with Robust Reporting Tools

Gain instant visibility into equity compensation across your enterprise and refocus limited resources on higher-value activities. Reporting tools designed to meet SEC, FASB, and IFRS regulatory requirements enable you to streamline ASC 718 compliance and reporting, and to automatically generate 6,039 tax reporting statements and filings.

Integrate Seamlessly with the Critical Systems You Depend On

Connect to your critical systems with pre-built connectors. Share data with your broker trading system of choice to provide equity plan participants with a seamless experience. Eliminate the need to change equity platforms if you decide to change your preferred broker. Synchronize important tax and employee demographic information with your HR payroll system to shrink your payroll cycle and reduce the risks associated with hand-keying employee data.

Generate Accurate Ledger-Based Cap Tables

Deliver a new level of insight and analysis that grows with your business, underpinned by more organized data for better decisions and enhanced communications. Generate cap tables by date, ensuring that you have a comprehensive view of stakeholder holdings from a trusted single source of truth. Create high-impact distribution waterfalls to identify the pay-out for each class of security at any exit amount, so you can model and compare various term sheets and analyze the capitalization outcomes. We offer support for LLCs and complex capital structures, robust PIU, and MIU award support and functionality.

Reduce Employee Stock Purchase Plan (ESPP) Administrative and Accounting Burdens

Ensure accurate record keeping and support all aspects of your plan, from managing eligibility to processing purchases. Design flexible ESPP plans that meet your needs when setting up offering periods, purchase periods, and fair market value price definitions. Enable participant web self-service to increase employee engagement while offloading everyday tasks. Stay on top of enrollments, contributions, purchases, and disqualifying dispositions with a robust set of administrative and accounting reports.

Simplify and Streamline all Aspects of Stock Administration and Reporting

Offload your day-to-day equity administration to our expert team of certified equity professionals. Our equity professionals are always on hand to answer your questions as they partner with you to deliver your equity plan. We also work alongside you current broker and other broker partners, and our flexible options make it easy to customize your services to suit your business needs. Reduce risk and ensure compliance with a transparent and documented stock plan procedure manual, stronger controls, and optimized processes, all backed by regular scheduled reviews.

BEST-IN-CLASS FEATURES

Cap Table and Equity Management Software

- Simplified web-based platform for complete SEC, FASB, and IFRS calculations

- Supports for over 15 award types

- Full audit trail to track changes

- Grant modifications

- Simplified data import

- Administrative alerts

- Cap table management and waterfall analytics

- ESPP administration and accounting

Enterprise-Class Accounting Calculations and Reporting

- Expense calculations and journal entries

- Earnings per share/dilution calculations

- Tax accounting and reporting for deferred tax asset, deferred tax benefit, Additional Paid in Capital Pool Amounts, and jurisdictional tax allocations.

- Library of customizable, pre-built reports including disclosures and proxy reporting

- Modeling and forecasting tools

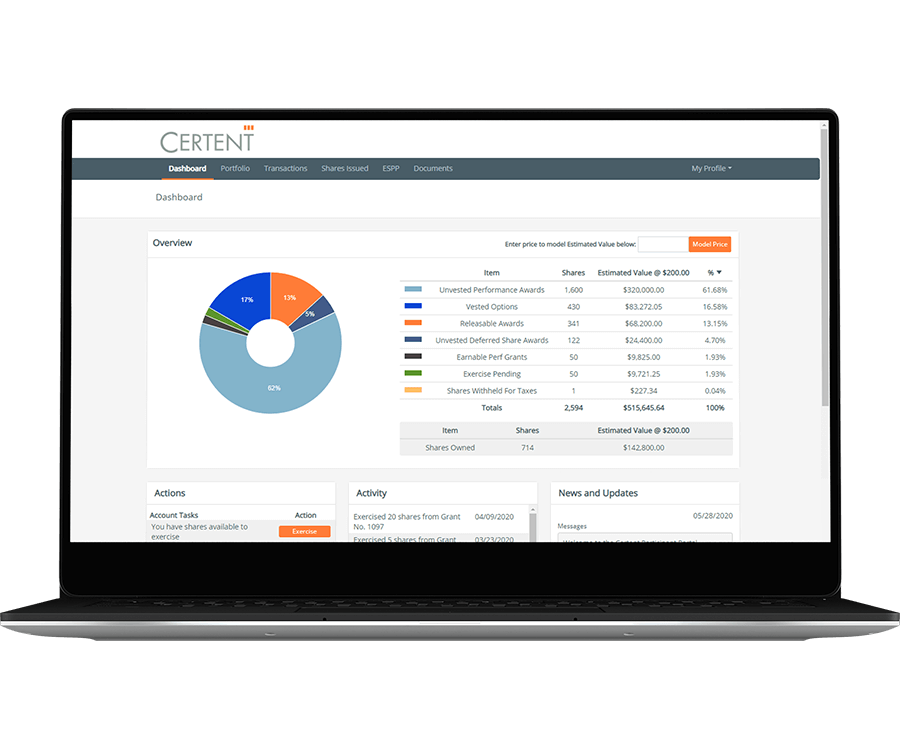

Self-Service Participant Portal

- Online grant delivery and acknowledgement

- Connection to your broker of choice

- Support for end-to-end exercise and settlement process

- Flexible share payment methods

- Participant email communications

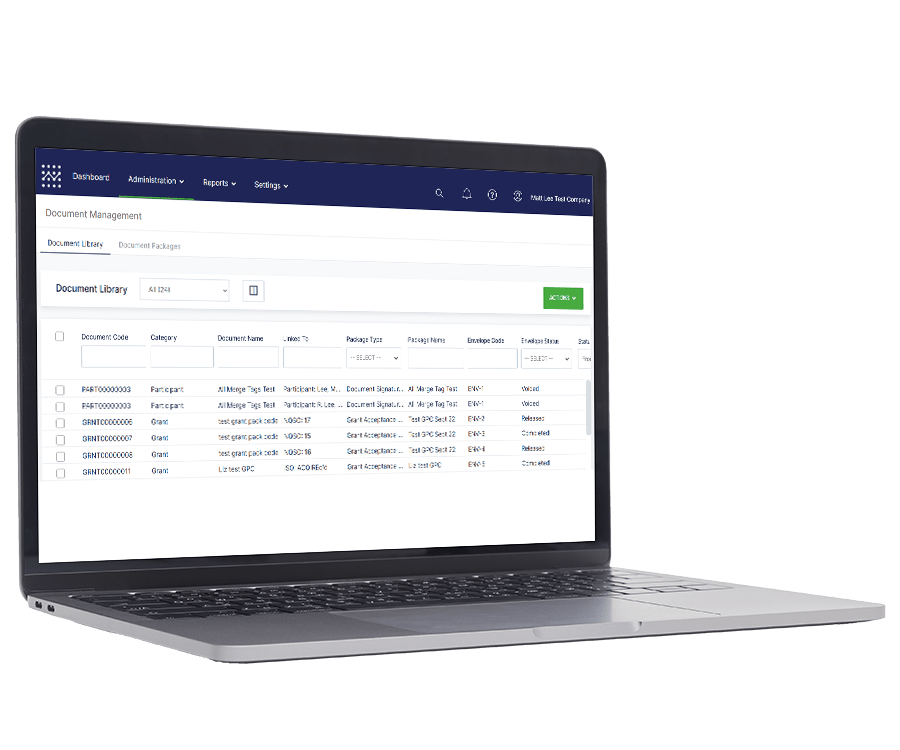

Document Management

- Upload single or multiple documents including agreements and plan terms and conditions

- Distribute as standalone documents or document packages and track them easily and efficiently

- Manage signing process (when required) through an integrated signature collection app. Create a signature hierarchy for documents requiring multiple signatures to ensure people sign in the correct order

- Provide access through the participant portal or using a secure email link

Open Platform Connectors

- Connect to your broker trading platform, brokerage services, financial applications, financial reporting/ASC 718 services, HR applications, equity administration service, payroll system, and transfer agent service

- Automated two-way integration with payroll/HR system to synchronize tax and employee demographic information

- Pre-integrated, certified connections with leading brokers

Integrates with:

- Oracle E-Business Suite (EBS)

- Oracle EPM Cloud

- Oracle ERP Cloud

- Oracle Essbase

- Oracle Financial Consolidation and Close (FCCS)

- Oracle Fusion

- Oracle Hyperion Enterprise

- Oracle Hyperion Financial Management (HFM)

- Oracle Hyperion Planning

- Oracle PeopleSoft

- Oracle Planning and Budgeting Cloud Service (PBCS)

- Oracle Tax Reporting

- Deltek Ajera

- Deltek Maconomy

- Deltek VantagePoint

- Deltek Vision

- Deltek Vision Cloud

- Epicor Avante

- Epicor BisTrack

- Epicor CMS

- Epicor Enterprise

- Epicor Epicor SLS

- Epicor iScala

- Epicor Kinetic

- Epicor LumberTrack

- Epicor Manage 2000

- Epicor Prophet 21

- Epicor Tropos

- Infor CloudSuite Financials

- Infor Distribution SX.e

- Infor M3

- Infor System21

- Infor SyteLine

- Sage 100

- Sage 100 Contractor

- Sage 200

- Sage 300

- Sage 300 CRE (Timberline)

- Sage 500

- Sage 50cloud Accounting

- Sage AccPac

- Sage Adonix Tolas

- Sage Estimating

- Sage Intacct

- Sage MAS

- Sage X3

The Pre-IPO Regulatory Checklist

Most successful late-stage private companies dream of going public. Being a publicly traded company validates a company’s success, brings a tremendous amount of publicity for its products, and rewards its shareholders financially. It can also provide a powerful stream of financing dollars to boost growth via increased marketing, sales or R&D.

However, most founders are ill prepared to properly handle the tedious IPO process.

In this pre-IPO regulatory checklist, we look at the major steps that companies need to take in order to issue a smooth and successful initial public offering.

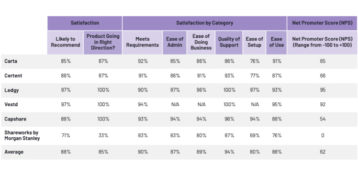

Work with the Equity Management Software Provider Rated #1 for Customer Satisfaction

"Certent Equity Management keeps the cap table accurate and allows me to provide accurate ownership information to the management team and shareholders quickly."

Speak to an Expert