Track, Record, and Report on Profit Interest Unit (PIU) Grants

Has Stock Plan and Cap Table Management Become a Productivity Drain?

Juggling Spreadsheets Puts Your Equity Compensation at Risk

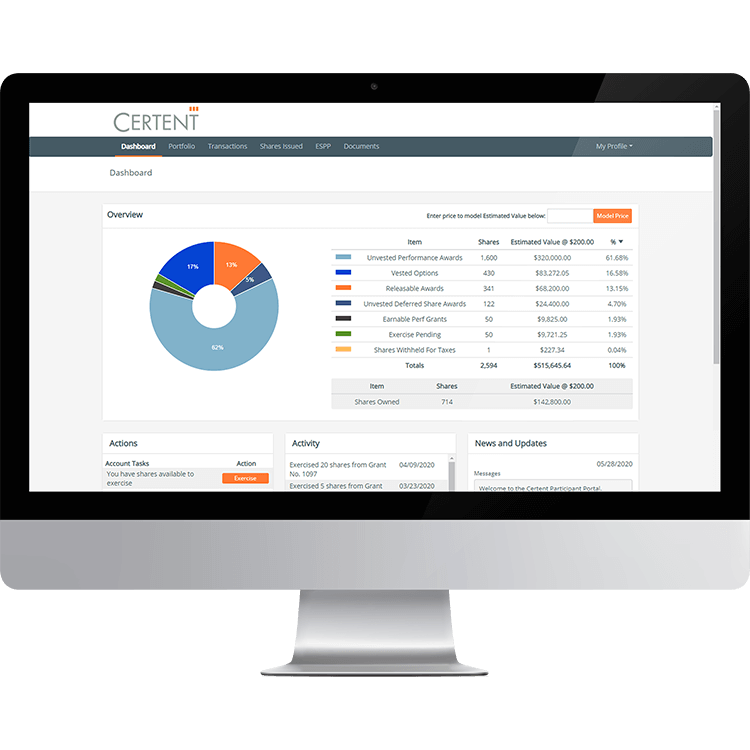

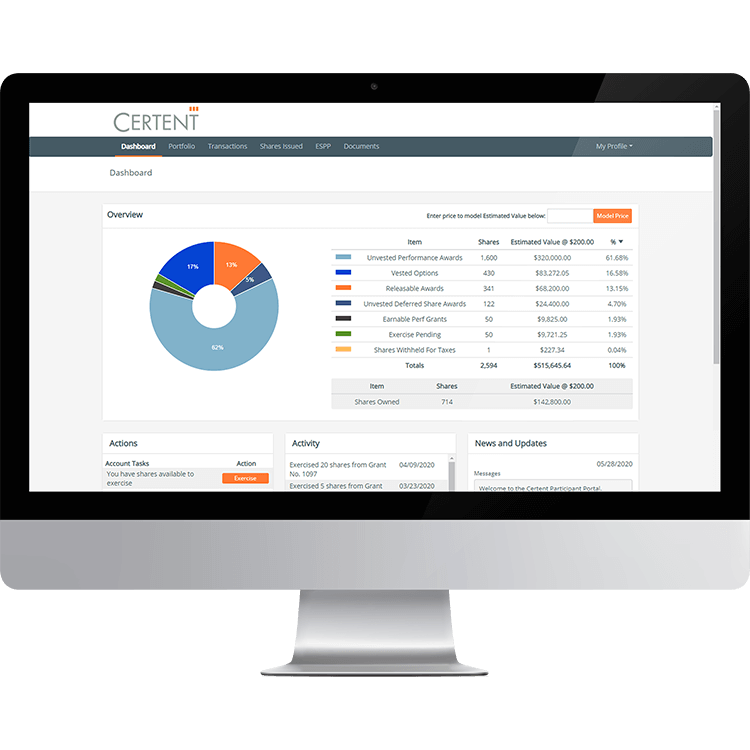

Equity plans are a vital component of your employee benefits package, involving multiple regulatory, tax, and compliance obligations. Managing them with spreadsheets creates unnecessary risks—one bit of bad data can put your entire dataset in jeopardy.

Your System Can’t Scale with Your Company’s Growth

From new share classes to employee recruitment, as your company has grown, so has your cap table’s complexity. Spreadsheets and platforms that once worked seamlessly quickly become unwieldy and risky to your business once your growth kicks into high gear.

You Devote Too Much Time to Administrative Tasks

The number of hours that your team spends copying and pasting data into Excel adds up. It is ineffective and wastes valuable time. Your people are skilled in their roles, but menial, repetitive tasks are limiting their potential.

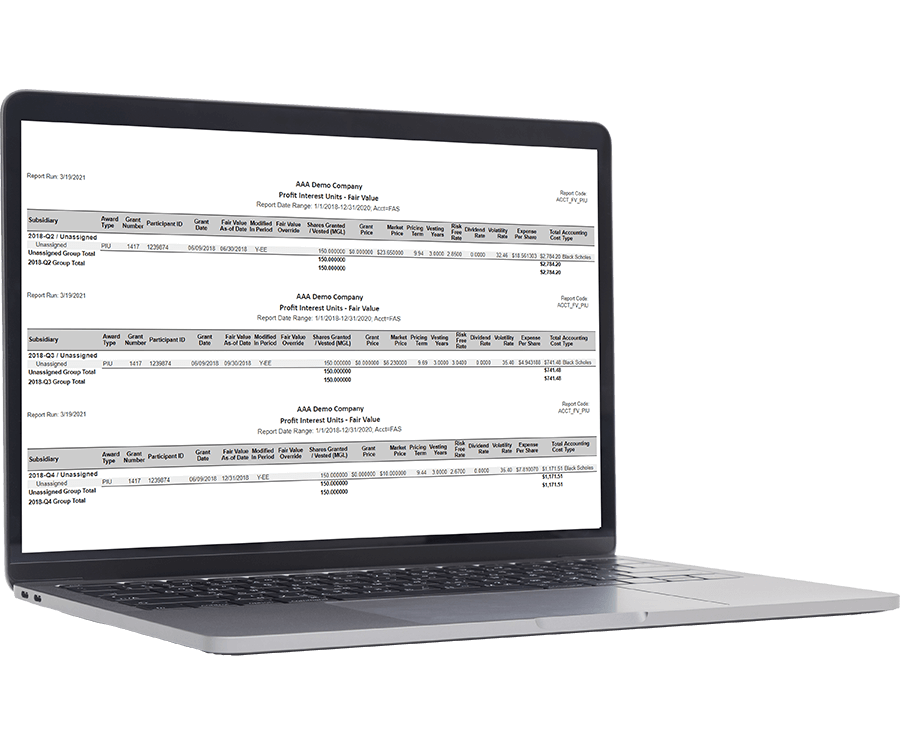

Track LLC/MLP Members and Record PIU Grants

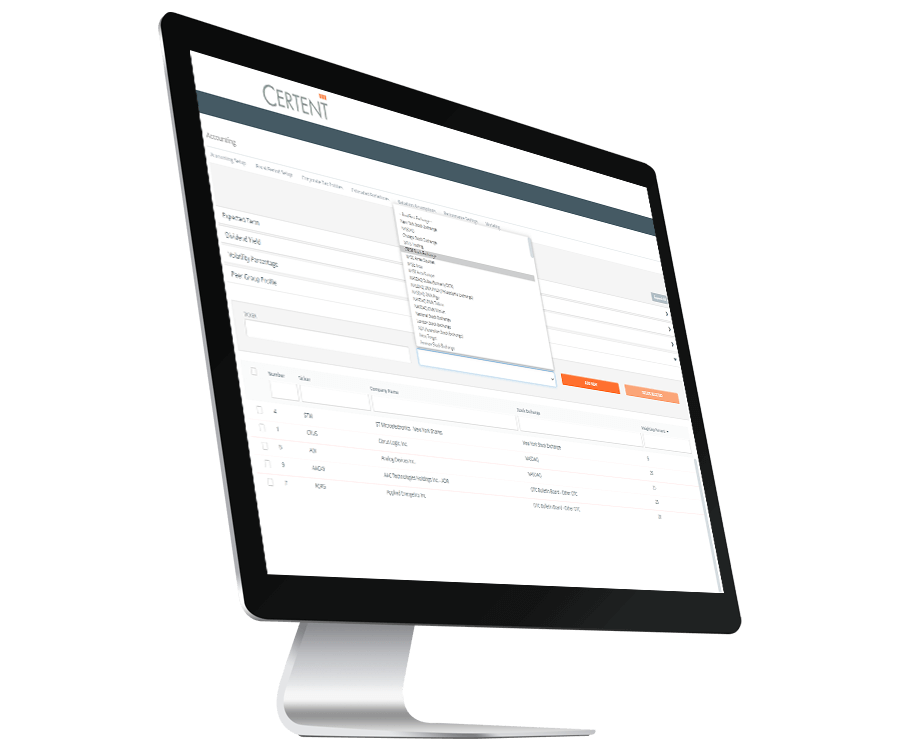

Certent’s expanded functionality includes the ability to track, record, and report on PIU grants. Our enhanced system is designed to accommodate the majority of PIU plans and features, including time- or performance-based vesting, distribution in stock or cash, separate accounting choice for each distribution method, and the ability to select if PIUs are displayed on capitalization reporting (cap table).

Get the Critical Reports You Need to Make Policy Decisions on Valuation

Certent’s PIU plan management allows limited liability companies to make policy decisions on valuation, whether Black Scholes or Intrinsic Value method, with stock payout distribution following ASU718 guidelines.

Quick Start Implementation for LLC/MLP Up to 100 Members

Like many growing companies, you need to move beyond manual spreadsheets or legacy software for equity management, but you simply don’t have the time or resources for a major software migration. Certent’s Quick Start services can help!

Integrates with:

- Oracle E-Business Suite (EBS)

- Oracle EPM Cloud

- Oracle ERP Cloud

- Oracle Essbase

- Oracle Financial Consolidation and Close (FCCS)

- Oracle Fusion

- Oracle Hyperion Enterprise

- Oracle Hyperion Financial Management (HFM)

- Oracle Hyperion Planning

- Oracle PeopleSoft

- Oracle Planning and Budgeting Cloud Service (PBCS)

- Oracle Tax Reporting

- Dynamics 365 Business Central

- Dynamics 365 Finance and Supply Chain Management

- Dynamics AX

- Dynamics CRM

- Dynamics GP

- Dynamics NAV

- Dynamics NAV C5

- Dynamics SL

- SQL Server Analysis Services (SSAS)

- Deltek Ajera

- Deltek Maconomy

- Deltek VantagePoint

- Deltek Vision

- Deltek Vision Cloud

- Viewpoint Spectrum

- Viewpoint Vista

- MRI Commercial Management

- MRI Financials

- MRI Horizon

- MRI Horizon CRE

- MRI Qube Horizon

- MRI Residential Management

- Epicor Avante

- Epicor BisTrack

- Epicor CMS

- Epicor Enterprise

- Epicor Epicor SLS

- Epicor iScala

- Epicor Kinetic

- Epicor LumberTrack

- Epicor Manage 2000

- Epicor Prophet 21

- Epicor Tropos

- Infor CloudSuite Financials

- Infor Distribution SX.e

- Infor Financials & Supply Management

- Infor Lawson

- Infor M3

- Infor System21

- Infor SyteLine

- Sage 100

- Sage 100 Contractor

- Sage 200

- Sage 300

- Sage 300 CRE (Timberline)

- Sage 500

- Sage 50cloud Accounting

- Sage AccPac

- Sage Adonix Tolas

- Sage Estimating

- Sage Intacct

- Sage MAS

- Sage X3

- 24SevenOffice

- A+

- AARO

- AccountEdge

- Accounting CS

- Accountmate

- Acumatica

- Alere

- Anaplan

- Aptean

- Assist

- ASW

- Aurora (Sys21)

- Axion

- Axis

- BAAN

- Banner

- Blackbaud

- BlueLink

- Book Works

- BPCS

- Cayenta

- CCH

- CDK Global

- CedAr e-financials

- CGI Advantage

- Clarus

- CMiC

- CMS (Solarsoft)

- Coda

- Coins

- Colleague

- CPSI

- CSC CorpTax

- Custom

- CYMA

- DAC

- Data Warehouse

- Datatel

- DATEV

- Davisware Global Edge

- Davisware S2K

- Deacom

- DPN

- e5

- eCMS

- Eden (Tyler Tech)

- Emphasys

- Entrata

- Etail

- Expandable

- FAMIS

- Famous Software

- Fern

- FinancialForce

- FireStream

- FIS

- FiServ

- Flexi

- Fortnox

- Foundation

- Fourth Shift

- Friedman

- Full Circle

- GEMS

- Harris Data (AS/400)

- HCS

- HMS

- IBM Cognos TM1

- IBS

- IBS-DW

- In-House Developed

- Incode

- INFINIUM

- IQMS

- iSuite

- Jack Henry

- Jenzabar

- JobBOSS

- Jonas Construction

- M1

- Macola

- MACPAC

- Made2Manage

- MAM

- MAM Autopart

- Manman

- Mapics

- McLeod

- MEDITECH

- MFG Pro

- MicrosOpera

- MIP

- Mitchell Humphrey

- Movex

- MRI

- MSGovern

- Munis (Tyler Tech)

- New World Systems

- Onesite

- Onestream XF

- Open Systems

- PDI

- Penta

- Plexxis

- PowerOffice

- PRMS

- Pro Contractor

- ProLaw

- Q360

- QAD

- Quantum

- Qube Horizon

- QuickBooks Desktop Premier

- QuickBooks Desktop Pro

- Quickbooks Enterprise

- QuickBooks Online

- Quorum

- RealPage

- REST API

- Retalix

- Ross

- SmartStream

- Spokane

- Springbrook

- Standalone DB with ODBC/DSN connection

- Standalone IBM DB

- Standalone Oracle DB

- Standalone SQL DB

- SUN

- Sunguard

- SunSystems

- Sys21

- SyteLine

- TAM (Applied Systems)

- Thomson Reuters Tax

- Timberline

- TIMELINE

- Traverse

- TripleTex

- Unit4

- Unit4 Agresso

- Unit4 Business World

- Unit4 Coda

- USL Financials

- Vadim

- VAI-System 2000

- Vantage

- Vertex

- Visma

- Winshuttle

- Wolters Kluwer CCH Tagetik

- WorkDay

- Xero

- xLedger

- Xperia

- Yardi

- Yardi-SaaS

Tracking Profit Interest Units for your LLC/MLP

LLCs and MLPs use Profit Interest Units (PIUs) to signify a member or partner holder as having an ownership/interest in the future profits of the company. As with all types of equity compensation, the ability to track time-based and performance-based vesting schedules is core, as well as flexibility to accommodate for plan adjustments, distribution methods, tax considerations, and broad reporting requirements. insightsoftware has expanded functionality to support PIU issuances within our award-winning SAAS Solution.

If you are currently using Excel or tracking your PIUs under an alternative award type that is not completely in line with PIU functionality and requirements, you won’t want to miss this session!

In this 30-minute session experts from insightsoftware’s product team will:

- Review the expanded functionality now available within insightsoftware to record, track, and report on Profit Interest Units.

- Discuss how insightsoftware’s PIU plan management allows companies to apply their policy decision on accounting types and methods for PIU issuances.

Watch Now!

The Equity Management Software Provider Rated #1

for Customer Satisfaction

“We needed a solution that allowed our analysts to have real-time access to the data, and that gave our management a clear vision of what's happening at any given time.”

Speak to an Expert