Compliance Confidence

Equity Management, Disclosure Management,

and Disclosure Research

Certent is now part of insightsoftware, – a leading provider of financial reporting and enterprise performance management software.

"*" indicates required fields

Certent, developer of Certent Equity Management, Certent CDM, and Certent DisclosureNet, is now a part of the insightsoftware family.

insightsoftware is a recognized leader in business software solutions. This means Certent’s customers and channel partners now have access to a broader portfolio of solutions that connect to a wide range of ERP and EPM systems. insightsoftware’s strategy is to offer our customers the right financial and operational reporting, visual analytics, and planning solutions regardless of company size, ERP, EPM, or reporting environment preferences.

Learn More About the Certent Family of Products

Certent

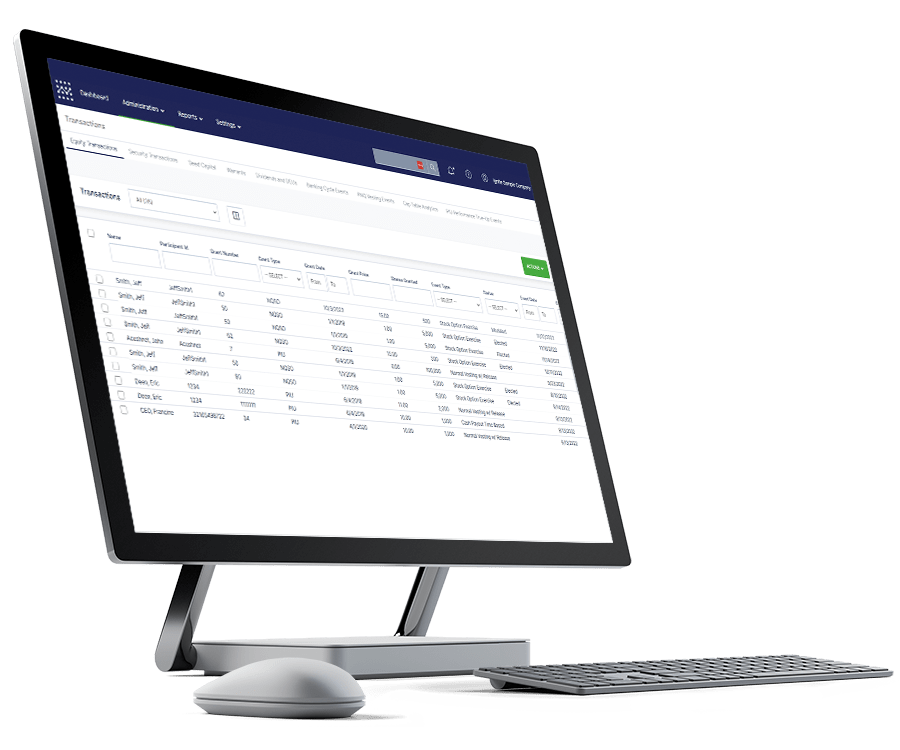

Equity Management

Whether you’re a public or private company, Certent Equity Management offers everything you need to manage, administer, account for, and report on equity compensation plans. Streamline your equity management, tighten compliance, minimize risk, and improve your productivity.

Certent CDM & Disclosure Management

Reduce disclosure risk with the only all-in-one, Microsoft Office- based, disclosure management solution. Use anywhere you want to combine words and numbers for publication, not just for regulatory and statutory reports. Exercise control over high frequency, recurring, multi-author reports. Bring speed, accuracy, and consistency to a laborious, error-prone, and uncontrolled process.

Certent

DisclosureNet

Simplify access to disclosure research including legal, accounting, investor relations, and business development. Get unfettered access to a comprehensive suite of accounting standards, rules, and regulations that are full-text searchable. Filter searches of EDGAR, SEDAR, ASX, and HMRC using more than 50 built-in criteria, including industry, exchange, the company auditor, and filing date, and receive automatic email notifications as soon as filings are published.